By the end of 2025, the global real estate market will show a differentiated development trend under the dual influence of the low-interest-rate cycle and policy regulation.The Chinese market has broken through and adjusted its pattern with policy relaxation and REITs innovation, while the US market has achieved investment recovery by taking advantage of interest rate cuts. Both countries have made plans for revitalizing existing assets and allocating high-quality assets, reflecting new trends and opportunities in global real estate investment.

The global loose monetary policy has become an important support for the real estate market.In the United States, the Federal Reserve cut interest rates by another 0.25% in October, pushing the average 30-year fixed mortgage rate down to 6.22%, a significant decline from the beginning of the year. The market expects it to further fall to the range of 6.1% to 6.3% by the end of the year, significantly improving the affordability of home purchases, especially benefiting multi-family residential investments and property renovation projects.This measure not only stimulates the domestic transaction activity in the United States, but also eases the pressure of the interest rate differential between China and the United States, opening up space for China's monetary policy adjustment. The market generally expects that the domestic 5-year and above LPR is likely to be reduced by 10-15 basis points in the future, further lowering the cost of home purchase.

Many regions in China have simultaneously intensified policy support. During the National Day holiday, Shenzhen held nearly 30 housing exhibitions focusing on the affordable housing projects in Luohu District. In the "Golden Autumn October" housing fair in Xiaogan, Hubei Province, the proportion of high-quality residential transactions exceeded 50%. Wuhan's upgraded "Eight Han Policies" and other measures precisely targeted the goal of "having a livable home", revitalizing existing assets and enhancing investment return expectations through local subsidies and promotion activities.

JLL's report indicates that the global real estate cycle has shown a turning point. The decline in interest rates helps stabilize debt costs and inject liquidity into the markets of both China and the United States.

From the perspective of market fundamentals, the real estate markets in China and the United States exhibit differentiated characteristics of "recovery amid adjustment" and "steady warming".

Data from the National Bureau of Statistics of China shows that from January to October, the national real estate development investment decreased by 14.7% year-on-year, and the residential investment dropped by 13.8%. The market transaction volume shrank to a new low in four months, and the wait-and-see sentiment still exists.

However, Li Bei of Banxia Investment pointed out that the decline in domestic real estate investment returns has driven trillions of yuan of savings to flow into channels such as A-shares and money market funds, creating A substitution effect in asset allocation.

The US market has demonstrated stronger recovery momentum. FHFA data shows that house prices rose by 2.2% year-on-year in the third quarter, with the median price reaching $415,200. The national inventory reached 2.08 million units, hitting a five-year high. Cash buyers accounted for 30%, dominating the Sunshine Belt market.

The commercial real estate sector has performed particularly well. CBRE predicts that commercial real estate investment in the United States will increase by 10% to 437 billion US dollars in 2025. The industrial logistics and retail sectors lead the way. The EQT Real Estate Fund completed the transaction of 8.7 million square feet of logistics asset portfolio, setting a record for the largest industrial asset transaction of the year, reflecting the strong market demand for assets with stable cash flow.

Revitalizing existing assets has become a common breakthrough for the real estate markets of both China and the United States, and the development of the REITs market has drawn particular attention.

On November 28, the China Securities Regulatory Commission released a draft for public comment on the pilot program of commercial real estate REITs, covering assets such as commercial complexes, office buildings, and hotels. It is expected to activate 40 trillion yuan of existing assets, become an alternative to high-dividend investments in a low-interest-rate environment, and optimize the investment structure of the real estate sector.

JLL emphasized that the urban renewal process in China is accelerating, and opportunities for converting old office buildings, hotels and other properties into long-term rental apartments are emerging, providing high-quality underlying assets for the REITs market.

The REITs market in the United States has formed a mature ecosystem. The P/E ratio of targets such as Realty Income has dropped to 35, lower than the five-year average level, becoming the focus of market attention.

The PGIM report indicates that, supported by expectations of stable interest rates, the global REITs market has achieved a moderate increase. Data centers in the United States, multi-family residences in Europe, and high-quality commercial assets in the Asia-Pacific region have become the concentrated directions of funds.

It is worth noting that foreign capital is accelerating its layout in China's core assets in a relaxed environment. High-end residences in Beijing and Shanghai, as well as high-quality office buildings in the Yangtze River Delta, have become hotspots for allocation. Meanwhile, the Sun Belt and Midwestern cities in the United States, such as Houston and Dallas, have become investment hotspots due to their employment advantages and affordability.

From a global perspective, Macquarie Asset Management predicts that global real estate returns will recover in the next 12 to 24 months, and the Chinese market is expected to benefit simultaneously from the policy dividends of REITs.

The NAR predicts that existing home sales in the United States will increase by 1.5% in 2025 and accelerate to 14% in 2026.

However, risk factors still need to be guarded against: China's third - and fourth-tier cities are facing high inventory levels and population outflow pressure, and 75% of the top markets in the United States have overvaluation issues. Investors need to be cautious of affordability challenges.

The core tone: The United States has entered an interest rate-driven recovery, while China is in a policy-catalyzed adjustment. REITs and industrial real estate are common investment highlights worldwide

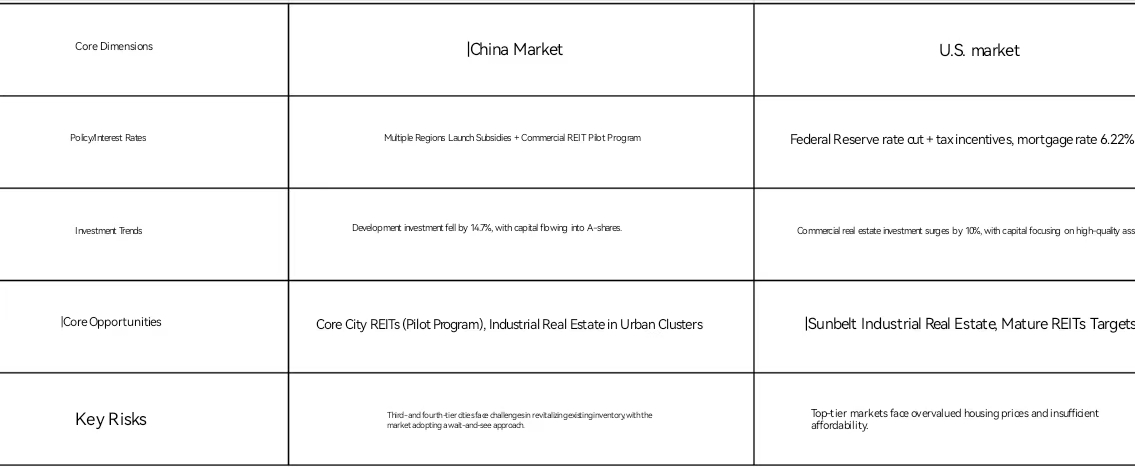

I. Core Comparison of the Chinese and US Markets (Concise)

The core dimensions are the Chinese market and the US market

Ii. Key Points of Core Asset Investment (Must-Read

1. REITs (Core Driver

China: Pilot the activation of 40 trillion yuan of existing assets, with priority given to first-tier commercial complexes and old property renovation targets, and high dividends as alternatives under low interest rates

In the United States, the market is mature, with industrial/retail REITs leading the way. Low valuation and stable cash flow make it suitable for safe-haven needs

2. Industrial Real Estate (Growth Highlights)

- China: Smart logistics and industrial parks in core urban agglomerations (Yangtze River Delta/Pearl River Delta), compatible with REITs+ foreign investment layout

In the United States, logistics assets in the Sun Belt and the Midwest have seen a surge in transactions, stable cash flow, and are significantly benefiting from interest rate cuts

Iii. Core Suggestions for Investors

1. The United States: Invest in industrial real estate in the Sun Belt and low-valued REITs to seize the recovery dividends driven by interest rates.

2. China: Focusing on the first batch of REITs pilot targets and industrial real estate in core urban agglomerations, waiting for further policy catalysis;

3. Global Perspective: Avoid the overvalued markets in China's third - and fourth-tier cities and the top ones in the United States

Overall, the global real estate market at the end of 2025 is in a critical period of policy dividends and structural adjustment. The low-interest-rate environment provides liquidity support for the market. REITs innovation and high-quality asset allocation have become the key to breaking the deadlock. Although the markets of China and the United States have taken different paths, they are both developing in the direction of "stabilizing the existing volume and improving the quality".

Investors need to seize the structural opportunities in the high-quality assets and policy support areas of core cities.

Email: info@sinoamericanrec.org

Tel: +1(626)-658-6066

Office Address(Expect):Los Angeles county

Follow to our WeChat or leave a message in the form.

SAREC is a high-end cross-border platform that connects real estate developers, investment elites, fund managers, financial institutions and professional service providers in China and the United States.

Email: info@sinoamericanrec.org

Tel: +1(626)-658-6066

Office Address:Los Angeles county

If you have a project or collaboration that you would like to discuss with us, or if you would like to know what solutions we can provide for you, we look forward to your consultation.

Contact Tel

Follow to our WeChat or leave a message in the form.